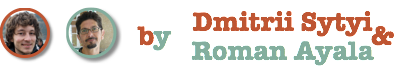

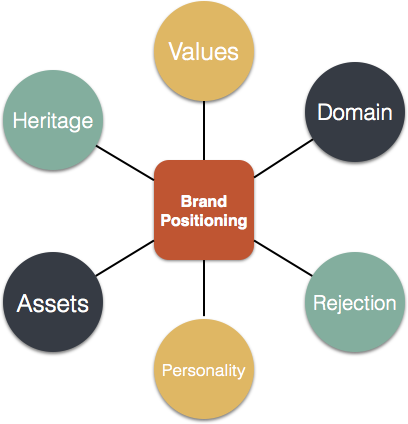

In order to compare the communication plan of the two companies, we are going to examine the anatomy of brand positioning of both companies. The brand positioning is composed of six elements:

- Brand heritage

- Brand domain

- Brand values

- Brand assets

- Brand personality

- Brand reflection

Source : http://www.staffs.ac.uk/sgc1/faculty/market-for-mans/week5.html

Source : http://www.staffs.ac.uk/sgc1/faculty/market-for-mans/week5.html

| |

Renault

|

Volkswagen

|

| Brand domain |

Popular car |

Popular car |

| Brand heritage |

“4 chevaux”MotorsportFusion with Nissan |

« Type 1 »DesignBeetle |

| Brand values |

Closeness with the clientSecuritySustainable mobility |

Customer focusTop performance Responsibility and sustainability |

| Brand assets |

DiamondRelation with motorsportsSloganAdvertising |

Design“Das auto” |

| Brand personality |

MotorsportsPartnerships |

Iconic brand imageThe Beetle |

| Brand reflection |

Good and secure French car |

Secure – Cool – Fun – Hype |

RENAULT

Brand domain

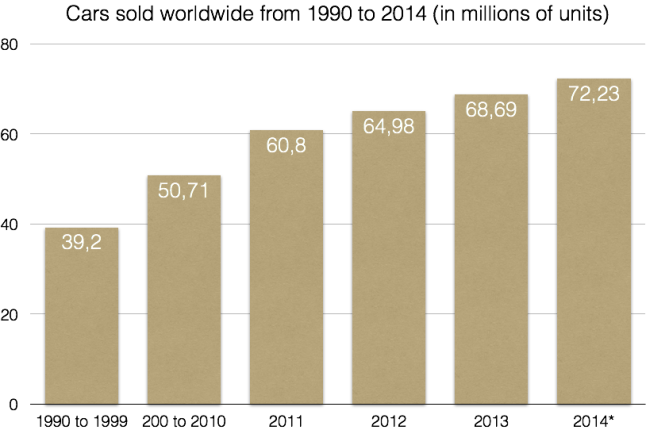

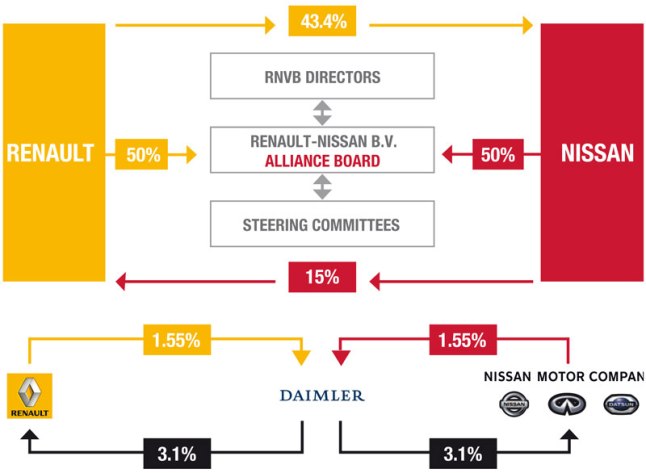

Renault in one of the main players in the automobile world market. Recently Renault-Nissan bought Samsung Motors and Dacia to develop its internationalisation strategy and certainly to expand its market. The acquisition of Samsung motors is strategic. In fact, Renault has set their sight on building a vast and modern state of the art manufacturing facility in Indonesia. This future facility will be producing about 240 000 cars per year. By this strategic plan, Renault and Nissan will have the opportunity to produce close to targeted Asian Market. Moreover, by acquiring Dacia, Renault was able to target a new market segment : base range and budget cars. It proved to be a successful step taken by the manufacturer due to the fact that Dacia reached a new sales record in 2013 (404 000 units).

Brand heritage

In 1898, Louis Renault and his brothers founded the Renault society. But at the beginning, Renault was just focusing on sports car. In fact, the society became famous thanks to the impressive results obtained in car racing competition. By 1905, Renault began to expand their market and started to produce vehicles targeting the general population. During the WWI, Renault created trucks, stretchers, ambulances, shells or tanks. Some of their models became world famous like the 4cv, la Dauphine, Renault 25 and nowadays with the Renault Espace, Megane, and Laguna. A very important part of Renault history was the merging event that occurred in 1999 with the Japanese car manufacturing Nissan Motors. The merger proved to be a very successful endeavor, unlike the failed merger attempt with the Swedish car giant, Volvo back in 1993. Nevertheless, these events indicated the shifting strategy that Renault was pursuing in order to gain internationalization of the brand and expansion into the emerging markets. Further reading can be found in dedicated post.

Brand values

Closeness with the client: One of Renault main differentiation strategy consisted in revolutionizing client relationships in a more efficient manner. According to Mr Plantegenest, commercial director of Renault, the objective for 2016 is to be the leader regarding customer relations. As he mentioned, Renault is among the top 5 car manufacturers and in some countries, is already the leader. By trying to meet and exceed customers expectations, the company is regaining lost terrain and it is constantly seeking new ways to do it more efficiently. Security: Renault relied greatly in innovation and development of advanced technologies for accident prevention. For example, Renault created ‘driver assistance’, a concept to anticipate inherited risks. The four objectives are: Prevent, correct, protect the occupants and protect children. These objectives are essential for Renault and it weights considerably in every decision that the company takes regarding the new technologies developed by the company. Sustainable mobility: Renault also was behind the whole concept known as ”Eco-conduite” Here, fuel efficiency became primordial due to the changing behaviors of the drivers. The main goal was to consume less fuel from previous years.

Brand assets

Diamond: the logo is very important in the car market. The story of Renault logo “the Diamond” is very specific. In fact, for the creation of the “40 chevaux” the installation of the alarm (the circular horn) was a huge problem for the manufacturers. This installation required a gap in car body. For the manufacturer this gap was not a good idea. And they find the solution. They were wearing a huge diamond of 25 cm high to hide the hole in the car body. And this diamond becomes the symbol of Renault. The diamond stay since 1925. Nowadays, the diamond is implemented in 3D.  Motorsports: The motor sport racing is closely associated with Renault history. A strong legacy and tradition were spearheaded by the company, thanks to their success in the world of car races. And nowadays, Renault have their own formula 1 racing team (Lotus-Renault). They also supply engines(power units) to 3 more teams. Slogan: “Drive the Change”. Over the years and with the continuous improvement of the brand, slogan also changed to keep up with the latest models innovation. But now this new slogan shows the importance of the new values of the manufacturer.

Motorsports: The motor sport racing is closely associated with Renault history. A strong legacy and tradition were spearheaded by the company, thanks to their success in the world of car races. And nowadays, Renault have their own formula 1 racing team (Lotus-Renault). They also supply engines(power units) to 3 more teams. Slogan: “Drive the Change”. Over the years and with the continuous improvement of the brand, slogan also changed to keep up with the latest models innovation. But now this new slogan shows the importance of the new values of the manufacturer.

- Sustainable mobility

- Innovation

In fact, Renault wants to be part of the new edge of Electric car. (Renault project Z.E.)

Advertising: The car manufacturer uses the same character on all TV commercial for the last 3 years( Nicolas Carpentier). He is not a world famous celebrity or a world leader, but it’s perfectly what Renault targets. Nicolas Carpentier is the perfect “normal guy”, he can be a father or a young worker. With this idea in mind o use only this character we know exactly that if we see this actor on a TV commercial it’s a Renaut add.

Brand personality

Motorsports: As previously mentioned, Renault history is closely associated with the motorsport world. Events like Renault 8 Gordini, the Alpine, and the creation of the Renault sport series, it becomes one of the most wealthy and influential car manufacturers, currently ranking number 4 worldwide. All these successful events drove the brand into the world stage where it showcase their expertise and efficiency due to the nature of these challenges where competition is very intense. Partnership: Renault was a part of huge and famous events. For 27 years, Renault was the official partner of the “Festival de Cannes”. This event is very famous and has a good impact on the image of Renault. (Luxury, Beauty, Charm…)

Brand reflection

Renault have the image of a “Good and secure French car”. No one will describe the car as a luxurious car. It’s a car not expensive that can be convenient for all the family. For instance, the Renault CLIO is one of the most esteemed cars by French people according to a recent survey did by the CCFA (comité des constructeur français d’automobile).

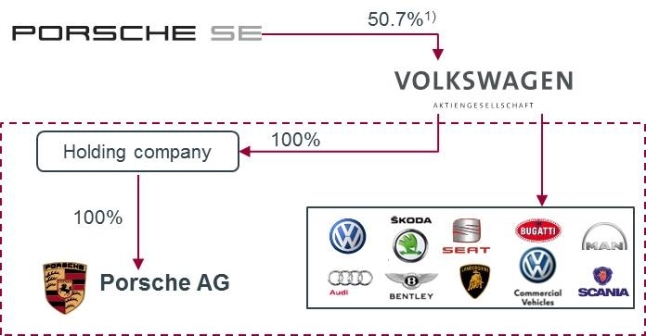

VOLKSWAGEN

Brand domain

Volskwagen is implemented since 1930’s in the automotive market for middle class. Over time, the Volkswagen Group acquired other brands such as Audi, Seat and Skoda in order to position itself in every segment. In addition, they also diversify on the markets of trucks and motorcycles.

Brand heritage

Quality and authenticity are becoming key selling points in communication. In hard times, people are looking for comfort from the past. That is why in 2008, in an effort to get back to their German roots, Volkswagen created a talking Beetle, named “Max”, to interview German celebrities (Heidi Klum, David Hasseloff..) and deliver bad jokes with a fake German accent. The campaign’s weak attempt to link back to the birthplace of their brand via stereotypes attracted lots of negative comments and one of the biggest sales drops in recent years. VW’s Beetle is the best example of embracing their brand heritage. They took the original car concept and modernized the design to include conveniences and amenities that the buying public would demand. The brand heritage instilled in the Beetle is more than just names or symbols; they represent a legend or storyline that consumers can follow. Further reading in dedicated post.

Brand values

Customer focus: The brand wants to satisfy every segment of the population Top performance: Innovation for everyone is their trademark. In 2013, Volkswagen has become the most innovative company in the world according to the latest ranking of Booz & Company. The brand spent $ 11.4 billion in 2013 to research and development. Responsibility and sustainability: The Group pays real attention to the environment in the area of recycling and eco-consumption

Brand assets

Logo: Volkswagen or VW was founded in 1938 by order of Adolf Hitler in Stuttgart. In 1938, the first car to emerge was “Ladybug” by Ferdinand Porsche’s Volkswagen logo represents the V Volks (the people) and W Wagen (car) in a circle. Originally a cogwheel surrounded the circle. It disappeared after the second World War.  Slogan: Volkswagen currently distributes advertising with two different slogans:

Slogan: Volkswagen currently distributes advertising with two different slogans:

- “Das auto”: a reminder of the German origins of the brand. Indeed, everything that comes across the Rhine has de facto a positive connotation of quality and know-how.

- “Le plus dur, c’est de choisir”: which perfectly corresponds with the brand positioning. Indeed, with this slogan, the brand claims all choices for every consumer.

Brand personality

Volkswagen is a globally recognised brand that is known by everybody thanks to its truly iconic brand image. In recent years, Volkswagen tops its rankings as one of the 20 best brands in the world. This shows that the Volkswagen brand is not only branded, but also highly wanted by the global market as well! Through effective brand differentiation, Volkswagen has created a positive brand image and likeability for its brand because people just love its brand’s distinctive personality. Furthermore, Volkswagen further strengthens its positive brand image by being a brand that is able to reach out to a wide scale of consumers ranging from car enthusiasts, corporate executives and family people. By launching different categories for its car models, Volkswagen is able to fulfil each and every of its customers’ needs. The Beetle is the part of brand personality of the brand. Indeed, created in1960s, it has been recently reincarnated forty years later. Today, customers celebrate the 1960s spirit symbolized by the flower vase on the dashboard.

Brand reflection

Brand reflection

After the purchase of Volkswagen drivers feel completely safe in a car on top of innovation. Indeed, the German automaker Volkswagen this year became the number one safety in its vehicles, award given by the American Insurance Institute for Highway Safety (IIHS). The hot ad agency Crispin Porter Bogusky created the new advertising last year for Volkswagen. Now there was a brand that had lost its luster and consumer loyalty. The brand reflection of owning a VW had become neutral at best, with many potential car buyers believing that the iconic German brand now was boring and stodgy. The declining sales of Volkswagen’s reflected this declining brand reflection. The agency came up with several edgy campaigns that, like them or not, injected some cool and fun back in the Volkswagen brand. Now owning a Volkswagen said you were hip and even kind of cutting edge about cars. The Volkswagen brand reflection was positive again, and sales rose (and are still rising). Of course, this coincided with Volkswagen also improving its product.

Sources:

http://www.ccfa.fr/Renault-veut-devenir-numero-un-de,124737 http://www.creads.fr/blog/nouveau-nom-nouveau-slogan/nouveau-slogan-renault-changeons-de-vie-changeons-automobile/ http://www.volkswagen.fr/fr.html http://www.brandrepublic.com/go/volkswagen/

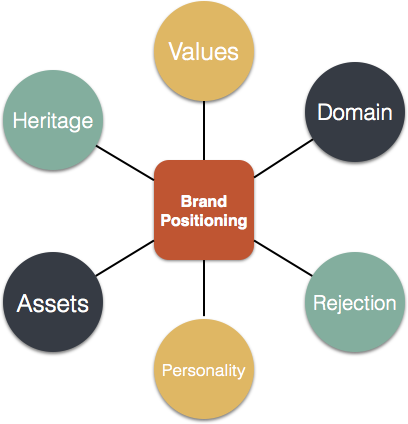

They tend to have a strong feeling of social responsibility. They often feel burdened by the global impact of their decisions, hence; minimising negative outcomes is a high priority. While choosing a car he/she will pay careful attention to levels of CO2 emissions, rate of fuel consumption, kind of fuel and materials used for manufacturing. Their ideal car would be an electric version, as long as it meets his/her budget.

They tend to have a strong feeling of social responsibility. They often feel burdened by the global impact of their decisions, hence; minimising negative outcomes is a high priority. While choosing a car he/she will pay careful attention to levels of CO2 emissions, rate of fuel consumption, kind of fuel and materials used for manufacturing. Their ideal car would be an electric version, as long as it meets his/her budget.